Starfish Space: Building the Missing Infrastructure Layer of the $630B Space Economy

Inside Starfish Space's In-Orbit Autonomous Approach Capabilities for orbital docking at scale.

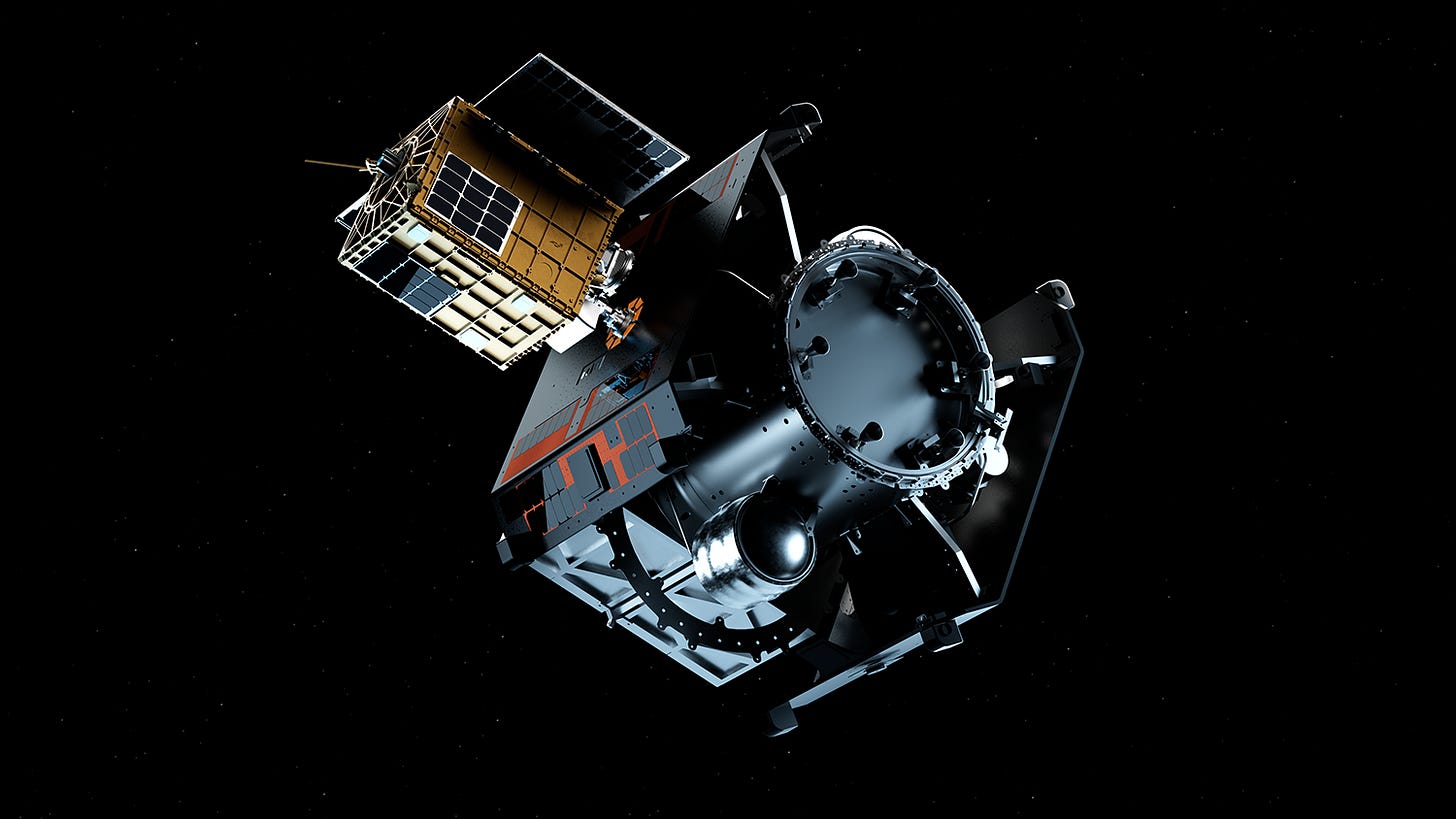

Bottom line: While everyone debates launch costs, the real transformation is happening hundreds of miles above Earth. Starfish Space isn't just extending satellite lifespans, they're building the missing infrastructure layer that turns space from a "launch and pray" cemetery into a dynamic, serviceable economy. Their Otter Pup 2 spacecraft is currently demonstrating autonomous approach capabilities in orbit, proving the building blocks for orbital docking at scale.

A Conversation with Co-Founder Trevor Bennett

The numbers tell a story most people miss. Satellites worth hundreds of millions of dollars regularly reach end-of-life not from catastrophic failure, but from something as mundane as running out of fuel. Meanwhile, billions of dollars in technically functional satellites continue circling Earth with perfectly operational payloads, sensors, and communication systems. The only thing broken? Their ability to maintain position.

Austin Link and Trevor Bennett, co-founders of Starfish Space, saw this massive inefficiency and asked a different question than the rest of the space industry. While others focused on launch costs, they focused on what happens after.

Six years later, Starfish Space is advancing the field of autonomous satellite servicing with their Otter Pup 2 mission, working toward complex rendezvous maneuvers in orbit with zero human intervention. But that's not the real story. The real story is what this capability unlocks next.

The Massive Inefficiency Problem

Most people think about space as a frontier. Trevor thinks about it as the world's most expensive supply chain problem.

"When you have a satellite that's getting old, your solution is go build another satellite that does the same thing to replace it," Trevor explains during our recent conversation. "What we can start doing with the newer technologies that we have, or at least the new business cases that we have, is to give optionality."

Starfish's approach to life extension missions represents significant potential cost savings versus replacement costs. But Trevor's vision extends far beyond keeping old satellites alive. They're building what he calls the missing infrastructure layer of space: the ability to service, modify, and orchestrate orbital assets like terrestrial infrastructure.

The market implications are substantial. Industry analysts project the satellite servicing market will reach $5.1 billion by 2030, growing from $2.4 billion in 2023.¹ Here's the key insight: this market category barely existed five years ago.

What's driving this explosive growth? As launch costs have decreased significantly over the past decade, satellite deployments have increased dramatically. "When you have more access to space, when people are launching more things, the value for maintaining in-space operations and maintaining and creating new opportunities goes up, not down," Trevor explains. The logic is straightforward: lower launch costs enable operators to deploy larger constellations, operate in more challenging orbits, and rely on space assets for business-critical functions they previously wouldn't attempt.

This creates a compounding effect. The more satellites operators launch, the more they need servicing infrastructure to protect their investments. Starfish is developing capabilities to address this growing population of satellites that will require servicing as the space economy expands.

Their solution involves breaking every space mission into modular building blocks.The

Lego Blocks of Space Commerce

Trevor breaks down Starfish’s approach: "The component pieces are: 1. Can you fly up near another spacecraft? 2. Can you identify and characterize that spacecraft through onboard capability? 3. Can you then approach it in its own reference frame and actually interface with another spacecraft? 4. And then once interfaced or docked, can you affect some kind of change?"

These building blocks enable dramatically different applications. For life extension missions, you complete all steps and end with propulsion assistance or fuel transfer. For space situational awareness, you might only need the first three: rendezvous, characterization, and close approach for detailed inspection. Component swapping or orbital assembly would use all the building blocks but with different end objectives.

The brilliance lies in the economics. Traditional space missions require expensive custom solutions. Starfish's modular approach aims to significantly reduce per-mission costs while expanding capability scope.

Rather than building satellites, Trevor clarifies they're building the construction equipment, repair shops, and logistics network that space has never had.

This strategy extends far beyond satellite servicing. They're building the infrastructure layer that makes space commerce possible. The applications extend across industries that don't exist yet:

Orbital data centers requiring regular hardware upgrades

Space manufacturing facilities needing component replacement

Deep space missions requiring refueling and resupply

Asteroid mining operations demanding logistics coordination

Each new space application increases demand for Starfish's services exponentially. Their roadmap reflects this ambitious vision: expanded operations with multiple Otter spacecraft capable of servicing numerous satellites annually, with long-term operations extending to lunar space and interplanetary missions.

The technology advances enabling this approach are substantial. Modern satellite servicing systems can achieve remarkable miniaturization compared to historical space docking technology.

Strategic Moats Through Operational Partnerships

Most space startups focus primarily on government contracts. Starfish has secured both government and commercial partnerships, including an operational partnership with a major commercial satellite operator.

Their Intelsat partnership represents a significant validation, providing access to one of the world's largest commercial satellite fleets. The recent Intelsat-SES merger creates an even more substantial partnership opportunity. As Trevor notes, working with experienced operators brings valuable insights: "Because they're really learning beyond what just a single mission could do. They can bring that to bear and help us avoid some of the potholes that might be true for a first mission."

This isn't a typical vendor-customer relationship. Starfish works closely with operator engineering teams, gaining operational insights that would be expensive to acquire independently. The result? Deep understanding of real-world satellite degradation patterns and servicing requirements.

Their Space Force and NASA contracts add crucial validation from government customers, demonstrating the dual-use nature of their technology across commercial and defense applications.

These partnerships create strategic advantages that extend beyond individual missions.

The Otter Pup 2 Demonstration

Right now, hundreds of miles above Earth, something remarkable is happening. Starfish's Otter Pup 2 spacecraft is preparing to execute autonomous orbital operations aiming for the first satellite docking in low Earth Orbit using electric propulsion.

The mission represents a significant technical achievement: Validation of core rendezvous and docking technologies.

Trevor’s excitement is focused on first steps: "When we get first light, we actually get to see the other spacecraft through our own eyes, through our cameras."

The Otter Pup 2 demonstration mission paves the way for operational missions. Starfish is developing capabilities to address the growing market for satellite servicing as space infrastructure expands.

“This is a docking mission, and I would love to see this spacecraft dock,” said Trevor intently.

Why This Matters Beyond Space

The implications extend far beyond orbital mechanics. Starfish represents a fundamental shift from disposable to serviceable infrastructure, relevant across industries facing similar "replace versus repair" economics.

Data centers spend billions replacing functional servers due to component failures. Offshore wind farms abandon functional turbines due to maintenance access costs. Remote mining operations shut down over equipment failures that would be trivial to fix with proper logistics.

Starfish's autonomous servicing model creates templates for solving in-orbit infrastructure problems where costs dominate replacement economics.

The Market Creation Story

Starfish represents something we see across the most successful defense and dual-use companies: they don't just improve existing markets, they create entirely new ones. The validation comes through market creation, not just market capture. Starfish didn't just build better satellite servicing, they created demand for satellite servicing that didn't exist before.

The space economy isn't about rockets anymore. It's about what happens after the rockets land.

Dr. Trevor Bennett is co-founder of Starfish Space, a commercial space company focusing on autonomous satellite servicing capabilities. With successful orbital operations, strategic partnerships across government and commercial sectors, and a $50+ billion addressable market, Starfish Space is building the infrastructure layer that transforms space into a serviceable economy.

Interested in learning more? Visit starfishspace.com to track their missions in real-time and see the future of space operations unfolding live.